With identity fraud hitting record highs in recent years, protecting your personal data isn’t just smart—it’s essential. From Social Security numbers to online banking credentials, cybercriminals are constantly looking for ways to exploit your digital footprint. That’s why millions of Americans now rely on identity theft protection services.

But which ones actually work? We reviewed the most trusted identity theft protection platforms based on U.S. consumer ratings, real-world effectiveness, features, and price in 2025.

Here are the top 7 identity theft protection services trusted by Americans today.

1. LifeLock by Norton

Rating: ★★★★★ (4.8/5)

Best For: All-in-one protection + device security

Price: From $7.99/month (first year)

Why It Stands Out:

LifeLock remains the industry leader thanks to its partnership with Norton 360. It monitors everything from credit activity and data breaches to dark web surveillance and SSN misuse. Their plans also include VPN, antivirus, and lost wallet protection.

Key Features:

- Credit monitoring from all 3 bureaus

- Identity and privacy alerts

- Up to $1 million in stolen funds reimbursement

- 24/7 U.S.-based customer service

2. Aura

Rating: ★★★★★ (4.7/5)

Best For: Families and tech-savvy users

Price: From $9/month (billed annually)

Why It Stands Out:

Aura is growing rapidly thanks to its intuitive dashboard and generous coverage. It offers real-time alerts, SSN tracing, online account monitoring, and even automatic data broker removal.

Key Features:

- Monitors bank accounts, SSNs, public records

- Child identity protection included in family plans

- $1M theft insurance + white-glove fraud resolution

- VPN and password manager built in

3. IdentityForce (a TransUnion Company)

Rating: ★★★★☆ (4.6/5)

Best For: Government workers and enterprise users

Price: From $17.95/month

Why It Stands Out:

IdentityForce has long been trusted by federal agencies and corporate entities. Their UltraSecure+Credit plan adds tri-bureau credit monitoring and full financial account protection.

Key Features:

- Medical ID fraud monitoring

- Real-time alerts for suspicious credit activity

- Secure mobile app

- $1 million identity theft insurance

4. Identity Guard

Rating: ★★★★☆ (4.5/5)

Best For: AI-driven risk detection

Price: From $7.50/month

Why It Stands Out:

Powered by IBM Watson AI, Identity Guard analyzes threat data in real time and offers proactive alerts. It’s especially good for people who want custom alerts and AI-enhanced risk scoring.

Key Features:

- Dark web and social media scanning

- Credit score tracking

- High-risk transaction alerts

- Family plans available

5. Experian IdentityWorks

Rating: ★★★★☆ (4.4/5)

Best For: Credit-focused users

Price: From $9.99/month

Why It Stands Out:

Offered by one of the three major credit bureaus, IdentityWorks offers strong protection for those most concerned about credit fraud. You get daily FICO scores and real-time alerts for any credit file changes.

Key Features:

- Daily FICO Score updates

- Experian credit lock

- Up to $1M in ID theft insurance

- Lost wallet assistance

6. PrivacyGuard

Rating: ★★★★☆ (4.2/5)

Best For: Affordability + basic monitoring

Price: From $9.99/month

Why It Stands Out:

PrivacyGuard is a reliable mid-range option with essential tools like credit monitoring, public records tracking, and dark web surveillance. It’s great for users looking for a budget-friendly entry into identity protection.

Key Features:

- Triple-bureau credit scores

- Monthly updates and alerts

- Public records and address monitoring

- U.S.-based fraud resolution team

7. Zander Insurance Identity Theft Plan

Rating: ★★★★☆ (4.0/5)

Best For: Budget-conscious users who want essentials

Price: From $6.75/month (individual), $12.90 (family)

Why It Stands Out:

Backed by financial personality Dave Ramsey, Zander’s plan is simple and effective. While it doesn’t offer credit monitoring, it focuses on fraud recovery and covers a wide range of identity-related issues.

Key Features:

- 100% recovery services

- Covers tax, medical, child ID theft

- Up to $1 million insurance

- No credit monitoring (must pair with other tools)

Comparison Table: Top Identity Theft Protection Services (2025)

| Service | Price (Starting) | Credit Monitoring | Theft Insurance | Family Plans | Device Security |

|---|---|---|---|---|---|

| LifeLock | $7.99/month | ✔ (All 3 bureaus) | $1M | ✔ | ✔ |

| Aura | $9/month | ✔ | $1M | ✔ | ✔ |

| IdentityForce | $17.95/month | ✔ | $1M | ✔ | ✖ |

| Identity Guard | $7.50/month | ✔ | $1M | ✔ | ✖ |

| Experian IDW | $9.99/month | ✔ (Experian only) | $1M | ✔ | ✖ |

| PrivacyGuard | $9.99/month | ✔ (All 3) | $1M | ✖ | ✖ |

| Zander | $6.75/month | ✖ | $1M | ✔ | ✖ |

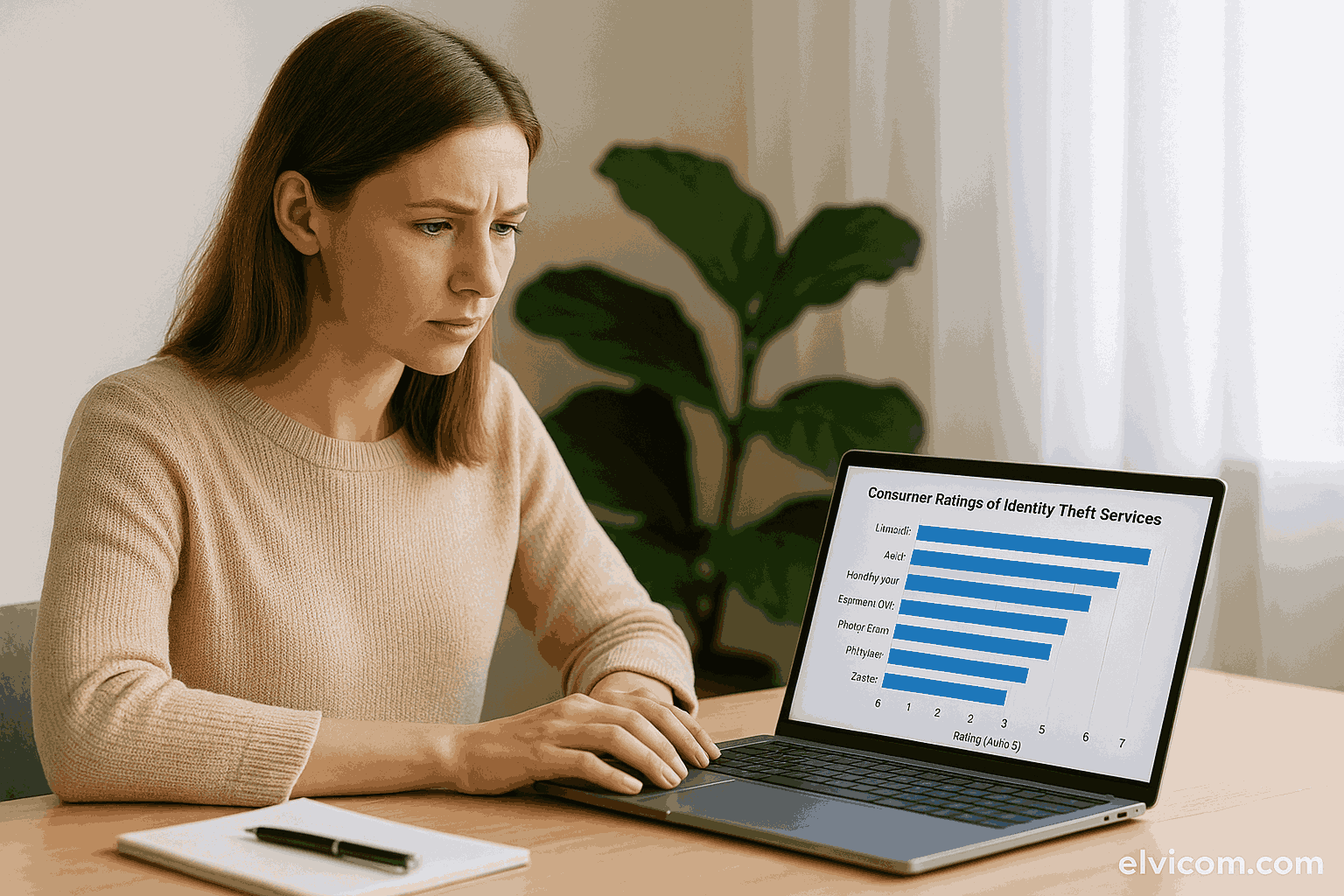

Bar Chart: Consumer Rating Score Comparison (2025)

| Service | Rating (Out of 5) |

|---|---|

| LifeLock | 4.8 |

| Aura | 4.7 |

| IdentityForce | 4.6 |

| Identity Guard | 4.5 |

| Experian IDW | 4.4 |

| PrivacyGuard | 4.2 |

| Zander | 4.0 |

What to Look For in a Protection Service

- Credit Monitoring: Check if they offer single or tri-bureau monitoring.

- Real-Time Alerts: Quick detection = fast damage control.

- Insurance Coverage: $1 million is the industry standard.

- Recovery Assistance: Top services offer full restoration with dedicated case managers.

- Family Coverage: Look for child ID protection in family plans.

Final Thoughts

Whether you’re a parent safeguarding your children’s identity, a professional protecting your credit, or a retiree securing financial data, identity theft protection is no longer optional in 2025.

Choosing the right service depends on your needs—do you want credit score updates, device protection, or fraud recovery? Fortunately, the services above offer flexible plans, smart tools, and peace of mind.

Hashtags:

#IdentityProtection #BestIDTheftServices #CyberSecurity2025 #ConsumerRatings #Elvicom

Website: https://elvicom.com