In 2025, your personal data is currency. From your shopping habits and search history to your address and phone number, companies are collecting, storing, and sometimes selling your information—often without…

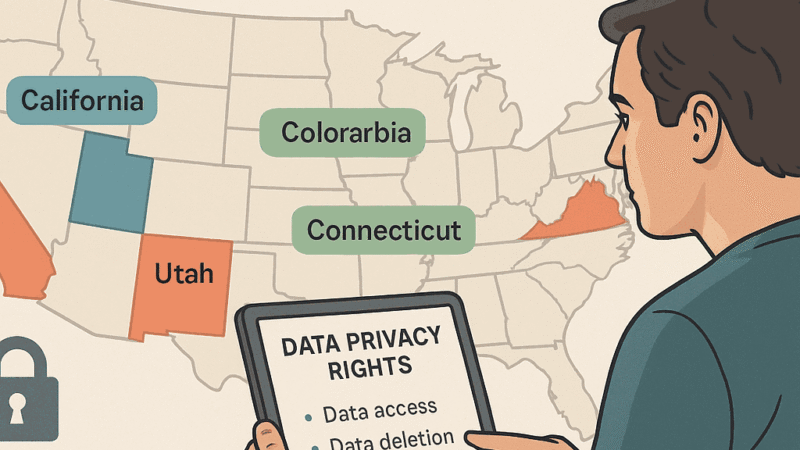

In 2025, data privacy is no longer a luxury—it’s a necessity. With online tracking, data brokers, and AI-driven profiling on the rise, more Americans are asking: “Who is actually protecting…

Online fraud is at an all-time high in 2025, from phishing emails and fake e-commerce stores to investment scams and hacked social accounts. If you’ve been targeted—or suspect fraud—you don’t…

The Fair Credit Reporting Act (FCRA) is one of the most important consumer protection laws in the United States—and yet, many people don’t know how it safeguards their credit and…

In today’s digital economy, data is one of your most valuable assets—and the way companies handle it is under global scrutiny. Two major privacy laws, the California Consumer Privacy Act (CCPA) and…

Credit fraud doesn’t usually start with a big red flag. It begins quietly—like a hard inquiry you didn’t authorize or a new account you didn’t open. That’s why credit monitoring…

Data breaches continue to rise in 2025, affecting everyone from everyday consumers to major corporations. If you’ve ever shared your email, used online banking, or shopped on the internet, your…

Having your Social Security number (SSN) stolen is more than just a privacy concern—it can lead to devastating financial and legal consequences. Identity thieves can use your SSN to open…

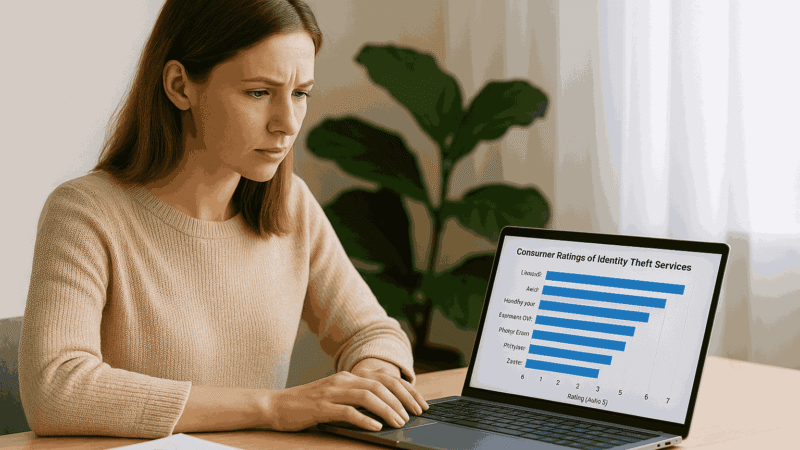

With identity fraud hitting record highs in recent years, protecting your personal data isn’t just smart—it’s essential. From Social Security numbers to online banking credentials, cybercriminals are constantly looking for…

Freezing your credit in 2025 is one of the smartest ways to protect your identity and personal financial data. With cyberattacks and data breaches on the rise, the need to…