The Fair Credit Reporting Act (FCRA) is one of the most important consumer protection laws in the United States—and yet, many people don’t know how it safeguards their credit and privacy.

Whether you’re applying for a loan, a job, or even renting a home, your credit report can impact the outcome. That’s why it’s critical to understand your FCRA rights and how to use them effectively in 2025.

This guide breaks down the Fair Credit Reporting Act in simple terms so you know exactly what you’re entitled to and how to respond if something goes wrong.

What Is the FCRA?

Enacted in 1970 and updated multiple times since, the Fair Credit Reporting Act (FCRA) governs how credit reporting agencies collect, access, share, and correct consumer credit information.

It applies to:

- Credit bureaus (Experian, Equifax, TransUnion)

- Financial institutions (banks, lenders)

- Employers and landlords who run background checks

- Any company that uses credit data to make decisions

The goal of the FCRA is to ensure fairness, accuracy, and privacy in the use of your credit information.

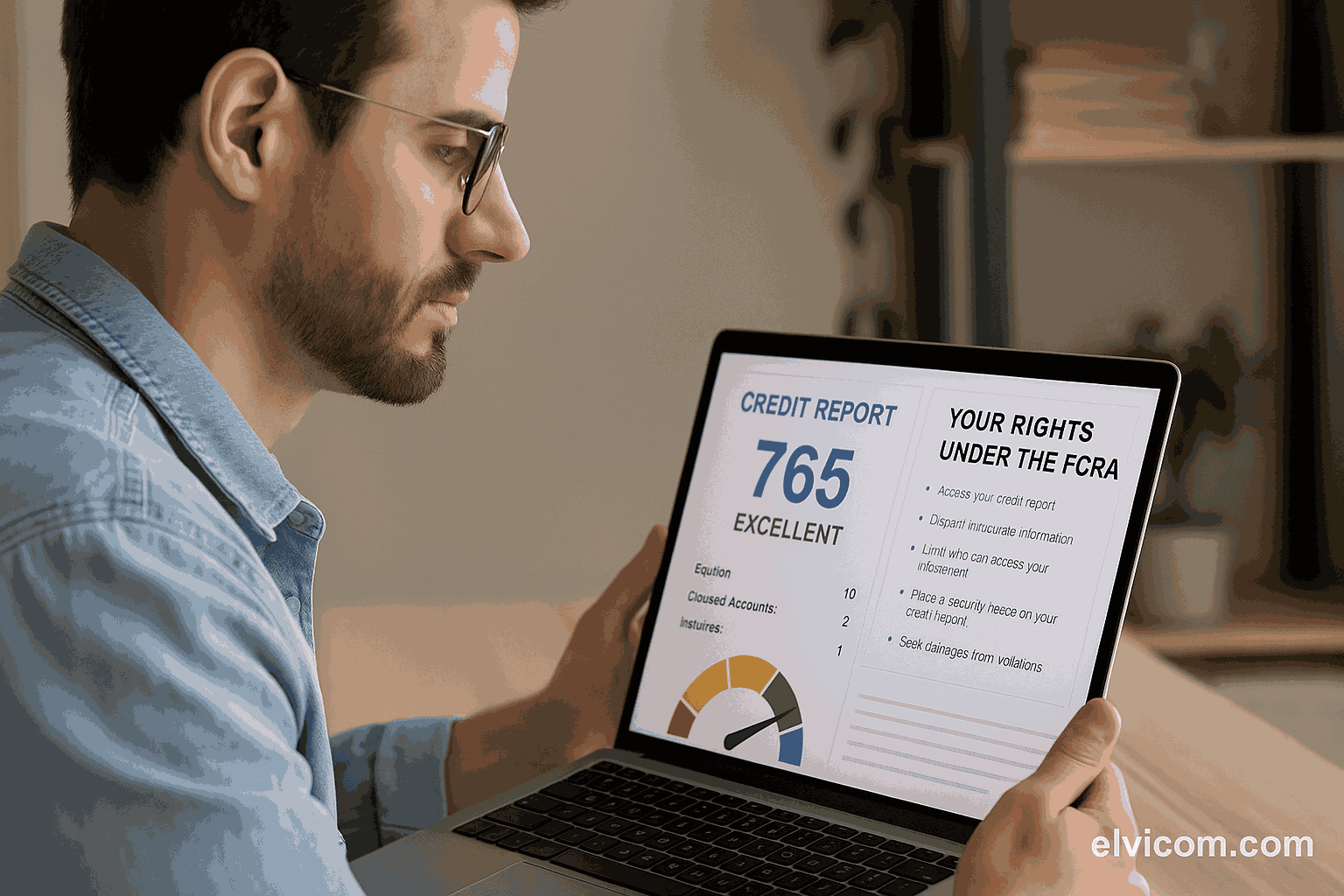

Key Rights Under the FCRA in 2025

1. The Right to Access Your Credit Report

You have the legal right to access your credit report for free once every 12 months from each of the three major credit bureaus through:

In 2025, consumers can still access free weekly credit reports from all three bureaus due to extended pandemic-era policy shifts.

2. The Right to Dispute Inaccurate Information

If your credit report contains errors—like incorrect accounts, wrong balances, or even fraudulent entries—you can dispute them at no cost.

Each bureau is required to:

- Investigate disputes within 30 days

- Correct or delete unverifiable information

- Notify you once the investigation is complete

Disputes can be filed online with:

3. The Right to Know Who Accessed Your Credit

Your report includes a section listing who has pulled your credit—whether it was a lender, employer, or landlord.

There are two types of inquiries:

- Hard inquiries: Affect your score (e.g., loan applications)

- Soft inquiries: Do not affect your score (e.g., preapprovals)

If someone accessed your credit without authorization, you may be able to file a privacy complaint under the FCRA.

4. The Right to Limit Access to Your Report

Only those with a “permissible purpose” under the law can access your credit data. This includes:

- Creditors considering you for credit

- Employers (with your written permission)

- Landlords or insurers

- Court orders or subpoenas

If someone accesses your report without cause, they can face penalties—and you may have a legal claim.

5. The Right to Place a Fraud Alert

If you believe you’re a victim of identity theft, you can place a free fraud alert on your credit file. This warns lenders to take extra steps to verify your identity.

There are two types:

- Initial fraud alert (1 year)

- Extended fraud alert (7 years) for verified ID theft victims

Place a fraud alert with any one bureau, and they must notify the others.

6. The Right to Seek Damages

If a company violates the FCRA—by failing to investigate a dispute, reporting false info, or leaking your report—you can sue for:

- Actual damages

- Statutory damages up to $1,000

- Punitive damages (in some cases)

- Legal fees and court costs

You can file complaints with:

- Consumer Financial Protection Bureau (CFPB)

- Federal Trade Commission (FTC)

- State Attorney General

7. The Right to Opt Out of Prescreened Credit Offers

You can prevent credit bureaus from sharing your data for pre-approved credit and insurance offers by visiting:

You can opt out for 5 years or permanently. This helps reduce unwanted mail and privacy risks.

Comparison Table: Core FCRA Rights

| Right | Description |

|---|---|

| Free Credit Reports | 1 free report per bureau annually; weekly free access (2025 extension) |

| Dispute Inaccuracies | Agencies must investigate and correct errors within 30 days |

| Know Who Accessed Your Credit | Viewable via inquiry section in reports |

| Restrict Access to Your Report | Only those with legal purpose may pull your credit |

| Fraud Alerts | Free alerts warn lenders of identity theft risks |

| Sue for Violations | Damages available for negligent or willful FCRA violations |

| Opt Out of Credit Offers | Stops marketing of pre-approved credit/insurance offers |

Bar Chart: Top Reasons Consumers File FCRA Disputes (2024 Data)

| Reason | % of Disputes |

|---|---|

| Incorrect Account Information | 41% |

| Identity Theft/Fraud | 27% |

| Inaccurate Credit Balances | 15% |

| Mixed File (Wrong Person) | 10% |

| Duplicate Listings | 7% |

The majority of disputes stem from errors that could lower credit scores or reflect fraud—underscoring why monitoring and knowing your rights is crucial.

FAQs About the FCRA

Q: Can I get more than one free credit report per year?

Yes. As of 2025, you can still access weekly free reports from each bureau thanks to extended post-pandemic policies.

Q: Does a fraud alert hurt my credit score?

No. A fraud alert does not affect your score and is a valuable protective measure.

Q: Can my employer check my credit?

Yes—but only with your written permission. They can’t access your score, just a modified credit report.

Q: What if a bureau doesn’t fix a mistake?

You can escalate the matter by filing a complaint with the CFPB or FTC and even sue under the FCRA if necessary.

Final Thoughts

Understanding your rights under the FCRA empowers you to take control of your financial identity. From accessing your reports to disputing errors and stopping unwanted access, the FCRA gives you powerful tools to protect your credit in 2025 and beyond.

Make a habit of checking your credit, watching for errors, and speaking up if something doesn’t look right—your financial future depends on it.

Hashtags:

#FCRA #CreditRights #CreditReport2025 #FinancialSecurity #Elvicom

Website: https://elvicom.com